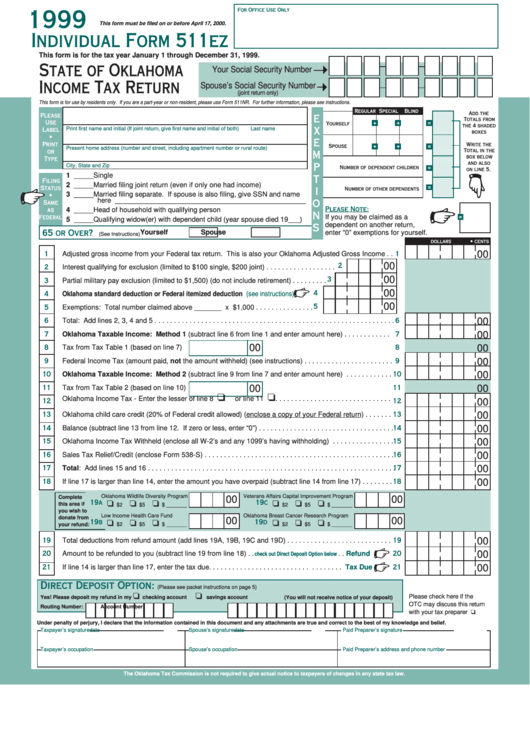

That top rate can be ranked 10th among the highest in states levying on an individual income tax.

North Carolina's individual income tax system contains three types of brackets as well as a rate of 7.75%.

#Tax return papers how to#

Their table tax table, bill of rights, tax rate schedules, how to get started with the state income tax and the tax return for the residents of North Carolina. This research would look closed at North Carolina department of revenue. The individual tax income differs in different states with each state having its own rights of running the tax provided by its residents. For an individual to be liable for personal income tax, one has to compute file tax returns, compute tax liability as well as pay the indicated tax as according to the calendar of the year. Here, individual refers to a person, non-juristic body of person, an ordinary person or an individual estate. If you are filing ITR or have filed ITR for a deceased member of your family, remember in that case, too, you have to keep the documents for either seven or 17 years from the end of the financial year, depending on the type of income the taxpayer had.Personal income tax or individual income tax refers to the levied tax on personal income. "Income tax department does have the power to ask details of old cases up to 10 years, however, this comes under exception where the department has proofs against you and this can be done in the search cases only," adds Soni. Soni says, "According to the amendment made in Budget 2017, applicable with effect from AY 2017-18 (April 1, 2017), income tax officers can now ask details up to 10-year-old cases that involves large amounts of escaped income."īut the income tax department cannot ask tax-related details from just about anyone it is meant for certain exceptional cases.

Yes, it is advisable to keep the documents for seven years, however, this does not mean that once the specified period is over, you can throw away the required documents. Wadhwa says, "For any individual having income relating to a foreign asset or having a financial interest in any foreign entity, then, in that case, such related documents must be kept for 17 years from the end of the relevant financial years." "The time limit for retaining documents for seven years from the end of the relevant financial year is same whether you are a salaried person, self-employed or a professional," Abhishek Soni, CEO, tax2win.in, an ITR filing website.įor those with income from foreign assets: If have any sort of income from foreign assets, then you will have to keep the ITR related documents for longer. The seven-year time period is applicable to various classes of taxpayers.

So, this would mean that if you have filed ITR for FY 2019-20, then you must keep the related documents with you till the end of FY 2026-27. He states that according to section 149, the income tax department has the powers to issue a notice to taxpayers for seven years from the end of the financial year. Chartered Accountant Naveen Wadhwa, DGM, says, "There is no provision in the Income-tax Act which suggests for how long the documents must be kept by the taxpayer." However, he adds, "Section 149 of the Income Tax Act specifies the time limit for issuing an income tax notice to an individual which can be interpreted as the time period for which documents must be kept." Nowhere does it say for how long you have to keep these documents.

#Tax return papers generator#

P2P Data Center Fuel Rates Diesel Rates Petrol Rates Bank Pan Number Bank holidays Penny Stocks MF Ratings & NAV Top Performing Schemes Top Star Rated Schemes Top Tax Saving Schemes Highest Risk Adjusted Return New Fund Offers Forthcoming Dividends NPS Top Performing NPS Scheme Most Consistent NPS schemes ETF Perfomance Latest Prices Listed Bonds Traded in Cash Market ULIPs ULIP Schemes Calculators Recurring Deposit Calculator Fixed Deposit Calculator LTCG Tax Calculator Income Tax Calculator Rent Receipt Generator SIP Planner Tool IFSC Bank Code NPS Calculator Invoice Generator EPF Calculator House Property Income HRA Calculator Sukanya Samriddhi Calculator Education Loan Calculator Car Loan Calculator Home Loan Calculator Personal Loan Calculator Risk Tolerance Calculator Financial Fitness Calculator Buy Online Health Insurance Car Insurance 2 Wheeler Insurance Interest Rates Recurring Deposit Rates Fixed Deposit Rates Bank Fixed Deposits Rates Post Office Schemes Rates MCLR Loan EMI Participate & Win Stocks & Shares ET Wealth ET Wealth Editions Buy Wealth Magazine ET Wealth Newsletter

0 kommentar(er)

0 kommentar(er)